After years with Farmers we just switched to Allstate; almost 50% less on Auto, and close but still savings on home owners. After signing up my local Allstate agent sent me a request for Drivewise. I called up and said I’m not interested in more oversight of my life; she said no worries and thanks for being a new customer.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Big Brother

- Thread starter boykinlp

- Start date

LVSteve

Member

Apparently the wife was a "hard braker".

It's amazing just how much lead the girls can pack into those strappy shoes that seem to be made mostly of empty space.

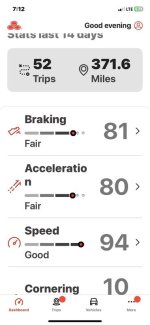

I have State Farm and my app says I saved $350.44 for 6 months. Whether that’s true or not I don’t know. I don’t mind using it.Braking 81 Accel 82 speed 94 cornering 100 phone 81. I drive a lifted Super Duty diesel so I don’t know about the acceleration score.

How are these scores determined?

Larry

Norton 750

Member

A buddy of mine had one, and his rate went down. Then they took a trip to Florida and he was keeping up with traffic and his insurance went thru the roof at renewal. Be careful chasing a few dollars.

As for me, if they can find a computer to plug it into they are welcome to it!

As for me, if they can find a computer to plug it into they are welcome to it!

Attachments

LVSteve

Member

A buddy of mine had one, and his rate went down. Then they took a trip to Florida and he was keeping up with traffic and his insurance went thru the roof at renewal. Be careful chasing a few dollars.

As for me, if they can find a computer to plug it into they are welcome to it!

People have to understand at which point "keeping up with traffic" becomes speeding. I use 5 over as my standard. If people want to go faster, it's their gas and license. I'll be the guy in the right lane they are passing who will wave cheerfully as they get their ticket a few miles up the 'pike.

twodog max

Member

No! to many spies out there I need no more. Actually need none

FWIW, the body shops around here have signs posted in their office that state they will not release any vehicle until they receive payment from Allstate. It seems Allstate is really bad about paying off claims. If you search on line, it's a reputation they seem to have nationwide. I'm not sure saving money would make up for not getting your car back in a timely manner.I signed up with Allstate when I switched from State Farm. The first six months I saved around $300. Next renewal I only saved $13 and change. I'll give it one more go round and see what happens. If I don't see bigger savings I'm going to drop it.

Allstate and State Farm "trackers" work differently.

In addition to tracking how many miles you drive State Farm looks at hard acceleration, hard braking, cellphone use, and whether you drive more than 10 mph over the speed limit as defined by Google maps.

Allstate doesn't care about acceleration or the speed limit. In addition to miles driven, they track whether you drive at 80 mph or above regardless of speed limit (there are highways in Texas with 80 mph speed limits and one or two toll roads with 85, but Allstate doesn't care), hard braking, cellphone usage, and late night driving which is supposedly more dangerous.

Edited to add that while both say you can save up to 30%, State Farm guarantees savings of at least 10% whereas Allstate does not.

smoothshooter

Member

Insurance rates are on the rise regardless of age, accidents, or where you live. I'm reading similar gripes on UK forums. First, the costs of everything involving repairs have spiked, some of that is supply chain related, some of it is due to the increased complexity of cars, and some down to the huge jump in the cost of utilities the shops use thanks to the Ukraine war.

The other factor very noticeable in the US is the hard core of drivers who got used to empty roads during COVID and were driving at mongo speed. These people point blank refuse to moderate their speed back to what is suitable for the current traffic density. We've had years of it in Vegas and our insurance rates have gone fighter plane vertical because of it. The death toll already this year is mind boggling. Oh, and if it isn't just speed, then it's drugs/booze and speed.

The above factors more than wipe out any benefit most of us think we should be getting for years of no wrecks.

How much of the rate increases there are due to all the illegals driving without licenses, drunk, and without insurance?

How are these scores determined?

Larry

I don’t really know. These are screenshots of my 14 day average and a trip to work.

Attachments

I say "Go for it!"I wonder if they could tell if I hooked it up to my lawnmower?

“USAA uses a phone app:

The USAA SafePilot program offers a chance to earn a discount for your safe driving habits. First, you’ll receive up to a 10% participation discount on your auto insurance policy for enrolling and participating in the USAA SafePilot program. Once you download and set up the USAA SafePilot App, it will automatically begin tracking your driving behavior, starting with a 14-day learning period. The learning period gives you a chance to learn how the app works, and gets to know your driving behaviors, before trips are considered towards your score.

When the learning period ends, you’ll have a fresh start for the remainder of your policy period. After you’ve driven an additional combination of 325 miles and 16 hours, you’ll be able to view your projected household discount of up to 30% for your next policy term.

Participation in the USAA SafePilot program won’t ever raise your premium. It’s simply a way to show you how well you’re driving and help you potentially earn a safe driving discount.

At every policy term renewal, we’ll reset your driving score and give you another fresh start.”

The USAA SafePilot program offers a chance to earn a discount for your safe driving habits. First, you’ll receive up to a 10% participation discount on your auto insurance policy for enrolling and participating in the USAA SafePilot program. Once you download and set up the USAA SafePilot App, it will automatically begin tracking your driving behavior, starting with a 14-day learning period. The learning period gives you a chance to learn how the app works, and gets to know your driving behaviors, before trips are considered towards your score.

When the learning period ends, you’ll have a fresh start for the remainder of your policy period. After you’ve driven an additional combination of 325 miles and 16 hours, you’ll be able to view your projected household discount of up to 30% for your next policy term.

Participation in the USAA SafePilot program won’t ever raise your premium. It’s simply a way to show you how well you’re driving and help you potentially earn a safe driving discount.

At every policy term renewal, we’ll reset your driving score and give you another fresh start.”

I don’t really know. These are screenshots of my 14 day average and a trip to work.

So I guess in this case, higher numbers are better.

Larry

Another thought crossed my mind. What happens when you take your vehicle to get serviced and they test drive it? Kinda like in the movie “Ferris Bueller’s Day Off” when they parked the Ferrari in the parking garage!

What happens when you take your vehicle to get serviced and they test drive it? Kinda like in the movie “Ferris Bueller’s Day Off” when they parked the Ferrari in the parking garage!

Larry

Larry

One tip to reduce your insurances costs, shop around and change carriers about every 3 years or so.

The companies believe they have you as a 'loyal customer' and take advantage of this loyalty by raising your rates every year.

Make sure you are getting the same, ie exact, coverage since changing a limit or amount can change the rate.

The companies believe they have you as a 'loyal customer' and take advantage of this loyalty by raising your rates every year.

Make sure you are getting the same, ie exact, coverage since changing a limit or amount can change the rate.

- Joined

- May 16, 2005

- Messages

- 15,428

- Reaction score

- 37,518

I've been wondering about his cornering, too!So I guess in this case, higher numbers are better.

Larry

When I lived in the Denver metro area I was insured by the Guy with the Emu lastly. Installed one of those doo-dads for three months. 6 month renewal almost doubled. Went to the good hands people. Up here it's a whole different ball game. And cheap.

So I guess in this case, higher numbers are better.

Larry

Absolutely. 100 would be great. When I first started using it I was in the 90’s. Most times now I don’t think about it until I’m asked for an odometer reading.

venomballistics

Member

Nope the only way I would have that spy in my car would be if required by law.

... and I'd stick it to a sloth at the zoo

Oldengineer

SWCA Member

I’m extremely spoiled. I’ve been driving Ford owned management lease vehicles for 4 decades and have not had to deal with car insurance. Ford does track my driving habits, etc., but they know we don’t listen to the bean counters. I do think that there might be a double standard — if police were monitored they wouldn’t have insurance! It’s either on or off.