Claim of - Tax Eliminated on Social Security Benefits - Mouse Print Says NO!

www.mouseprint.org

www.mouseprint.org

Before the bill passed, the Senate parliamentarian ruled that changes to social security could not be made in this type of bill and the provision to not tax social security benefits was completely removed from it.

*MOUSE PRINT:

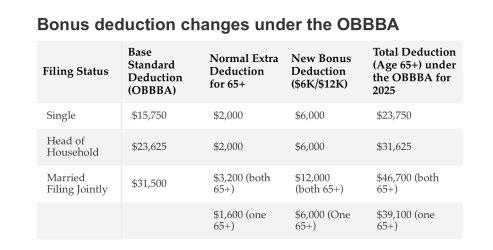

So how can the Social Security Administration claim the new law includes such a provision? They point to another measure in the law — a new $6,000 senior deduction — that would supposedly offset the income taxes that would otherwise be due on social security earnings for most people. The deduction is applied against other income too, however. And as their income rises, the deduction decreases to zero and is completely phased out after 2028.

*****

Bekeart

Some will rob you with a six-gun, And some with a fountain pen.

Mouse Print* – Exposing the strings and catches buried in the fine print.

Mouse Print exposes the strings and catches in advertising fine print.

www.mouseprint.org

www.mouseprint.org

Before the bill passed, the Senate parliamentarian ruled that changes to social security could not be made in this type of bill and the provision to not tax social security benefits was completely removed from it.

*MOUSE PRINT:

So how can the Social Security Administration claim the new law includes such a provision? They point to another measure in the law — a new $6,000 senior deduction — that would supposedly offset the income taxes that would otherwise be due on social security earnings for most people. The deduction is applied against other income too, however. And as their income rises, the deduction decreases to zero and is completely phased out after 2028.

*****

Bekeart

Some will rob you with a six-gun, And some with a fountain pen.