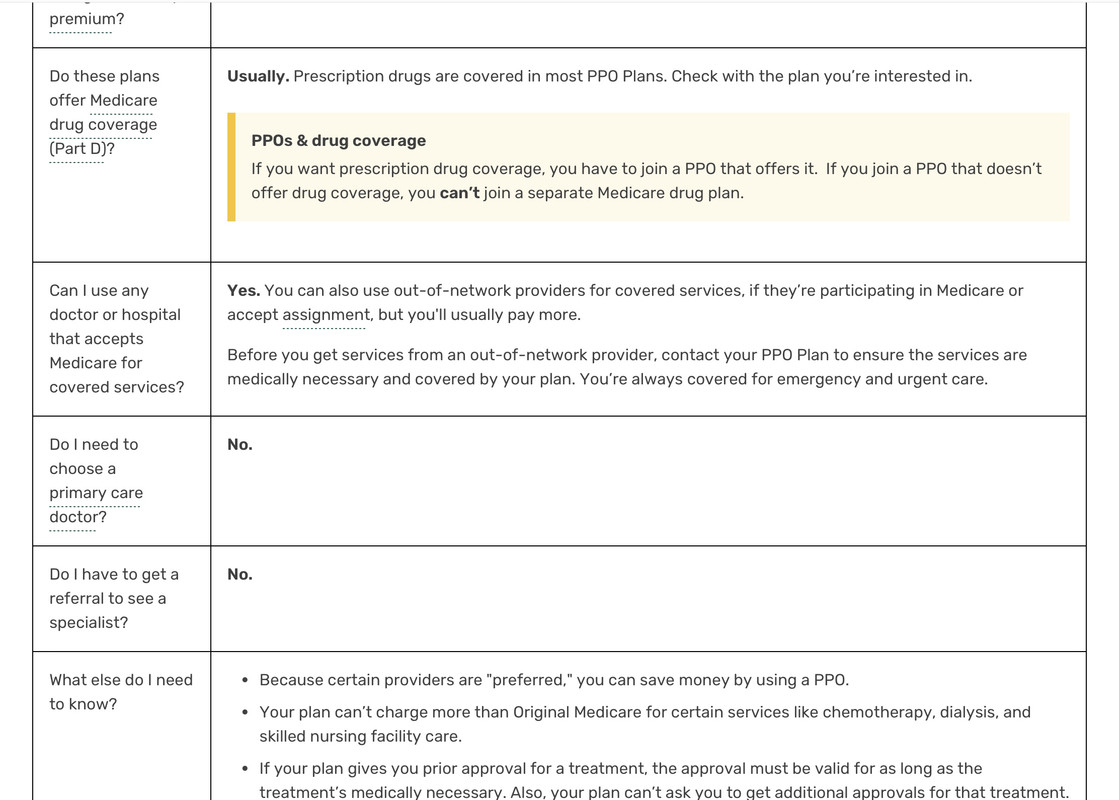

OK, the back story on my experience with the Medicare supplement that I have and my late hubby had. When hubby turned 65 had a call from Mutual of Omaha about the Medicare supplement plans, opted for the best one they offered. He was diagnoised with stage 4 cancer. Treated first locally, then to Mayo Clinic in Rochester. 8+ years later, about $1.2 million in charges, I paid I think $20.

We have good medical facilties locally for routine stuff but often are referred out of town or out of state. If anyone can show me a Medicare Advantage program that would provide the same full coverage at Mayo in Minnesota, Avera in Sioux Falls, SD, Sanford in Iowa, SD, ND, & MN, University of Iowa Hopitals, I would gladly listen. But in the meantime I'll keep what I know.