DWalt

Member

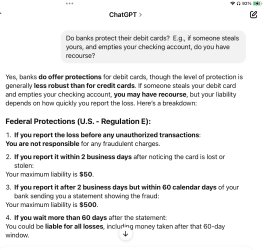

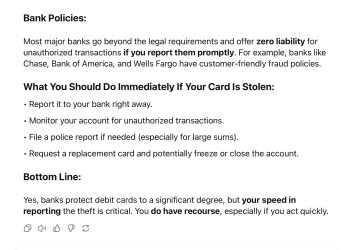

Precisely the reason I do not have nor want a debit card. No reliable way to prevent the balance in your bank account from being wiped out, and no recovery possible. Might be OK if you wanted to have a separate account for convenience debit card transactions while maintaining only a minimal cash balance in it, maybe kept at less than $500.Getting your CC skimmed at a gas pump is bad. Having it happen to your debit card is way worse.