I've a question as it's been a long time since I sold anything there.

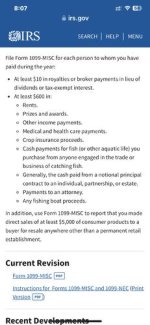

If you sell merch that totals over $600, does GB send you a 1099?

I ask because I do my part for the economy, viz. buy high and sell low.

So, if the answer to my question is yes, what if one buys a gun for $1,000, but sells it for $700? The seller realizes a net loss but still pays tax on the sale?

If you sell merch that totals over $600, does GB send you a 1099?

I ask because I do my part for the economy, viz. buy high and sell low.

So, if the answer to my question is yes, what if one buys a gun for $1,000, but sells it for $700? The seller realizes a net loss but still pays tax on the sale?