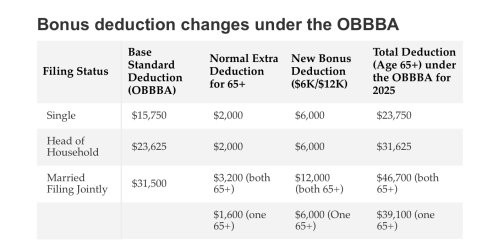

We just found that the new tax legislation will reduce our tax liability by around 33%. Both over 65 (easily) so the standard deduction will go up to a total of $12000 above the standard deduction for last year. For a married couple both over 65, last years standard deduction was $31,500. This ADDS 12,000 to that amount bringing it to a total of $43,500 for this taxable year (2025).

We have always taken the standard deduction since we have no significant deductions to itemize. We easily fall into the $250,000 limit for married couples. Generally it is half the amount for single taxpayers whose income does not exceed the $125,000 limit for singles over 65.

As a result of the effects of this new tax law, we will not be making the last two quarterly deposits in 2025 totaling $2400. The new law should drop us below the threshold for the 20% bracket, Pop's estate will add the interest on the CD's his gift now earns for me.

I would suggest everyone here who is over 65 look into the tax consequences for their personal situations.

If you are over 65 and make less that $125k single or $250k married then you stand to lower your tax liability (federal) by $2400. It also lowers your social security liability due to lowering the threshold of being taxed on social security.

We learned this from AARP. I suggest you do YOUR OWN research to assure yourself that you KNOW what you will save and adjust any estimated tax payments or deductions on retirement income to suit your circumstances.

I do not consider us to be rich by any standard, just thought many here could benefit from this new law.

There is nothing political in this post.

We have always taken the standard deduction since we have no significant deductions to itemize. We easily fall into the $250,000 limit for married couples. Generally it is half the amount for single taxpayers whose income does not exceed the $125,000 limit for singles over 65.

As a result of the effects of this new tax law, we will not be making the last two quarterly deposits in 2025 totaling $2400. The new law should drop us below the threshold for the 20% bracket, Pop's estate will add the interest on the CD's his gift now earns for me.

I would suggest everyone here who is over 65 look into the tax consequences for their personal situations.

If you are over 65 and make less that $125k single or $250k married then you stand to lower your tax liability (federal) by $2400. It also lowers your social security liability due to lowering the threshold of being taxed on social security.

We learned this from AARP. I suggest you do YOUR OWN research to assure yourself that you KNOW what you will save and adjust any estimated tax payments or deductions on retirement income to suit your circumstances.

I do not consider us to be rich by any standard, just thought many here could benefit from this new law.

There is nothing political in this post.

Last edited: